03 Oct How to Use a Mortgage Calculator to Plan Your Dream Home?

Purchasing your dream home, even with a loan, is not as easy as you think! Whether it’s your very first house or a property that has always been on your bucket list, knowing how much you can actually afford is key to seamless homeownership – and that requires thorough research. But with the advent of the world, you can now easily do it using a mortgage calculator in Melbourne.

Think of it as your best friend on your exclusive journey to acquiring the home of your dreams! With a loan calculator, you can take the stress out of home buying and take the right steps towards successful homeownership. While a home loan with a low interest rate can help you repay the amount in comfortable monthly installments, a mortgage calculator enables you to create a practical plan beforehand so you enjoy a trouble-free repayment journey.

No need to crunch numbers manually or flip through endless spreadsheets; the calculator can provide you with instant insights into affordability, monthly payments, and long-term financial impact, helping you get perfectly ready to take out a loan.

However, before you get to it, learn how to use it.

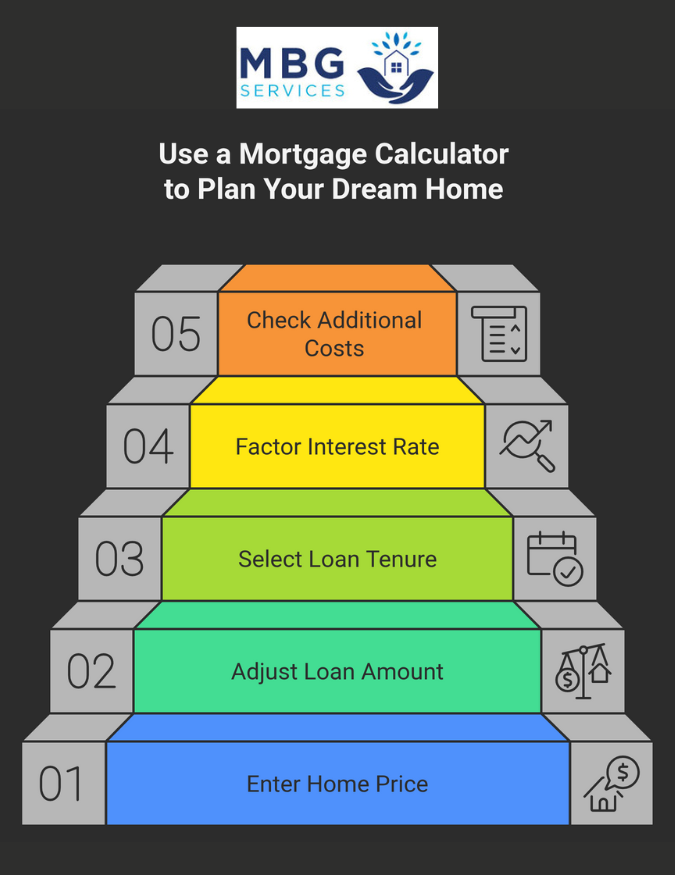

Step 1: Enter the Price of Your Dream Home

If you have the estimated price of your dream property in mind, enter it into the calculator. But if you’re still browsing homes, try different price points to have a good understanding of how each affects your monthly payments. With the calculated amounts you see, it’ll be easier for you to create a realistic budget and avoid stretching beyond your financial limits.

Step 2: Adjust the Loan Amount and Down Payment

The next most important factor is your down payment. The more you pay as a down payment, the lower your home loan amount, leading to lower monthly instalments and interest rates. With a mortgage calculator, you can try different down payment percentages – 10%, 20%, or higher – to find out how each changes your repayment plan and how much you can afford.

Step 3: Select the Loan Tenure

Most home loan calculators give you options like 15, 20, or 30 years. The loan term you choose has a huge impact on your repayment plan.

- Shorter-term loans (15–20 years): Higher monthly payments, but you pay less interest overall.

- Longer-term loans (30 years): Lower monthly payments, but more interest in the long run.

By toggling between terms in the calculator, you’ll see which balance fits your budget and future goals best.

Step 4: Factor in the Interest Rate

Interest rates can make or break affordability. A difference of just half a percentage can change your monthly payment by hundreds of dollars. Mortgage calculators allow you to enter the current interest rate or test “what if” scenarios.

For example, you might calculate payments at today’s average rate and then try slightly higher or lower rates to see how fluctuations affect your budget. This is especially useful if you’re planning to lock in a rate in the near future.

Step 5: Remember to Check Additional Costs

If you’re a first-time home buyer, you may forget about extra expenses – homeowner’s insurance, property taxes, and HOA fees – and that’s why this blog suggests that you shouldn’t. Most advanced mortgage calculators available today allow you to include these costs to get a more realistic monthly payment estimate for a home loan.

But with an experienced mortgage broker in Melbourne by your side, you don’t have to worry about your monthly loan repayments. While they always suggest you make the most of loan calculators to determine how much you can afford, they bring you the right products based on your financial needs and situations, while helping you choose the best one, so you buy your dream home without the stress.

Contact MBG Services Today!

At MBG Services, we specialise in bringing you the best home loan offers from trusted lenders so you buy your dream home with ease. Contact us today at 03 9492 4860 to just share your funding needs and current financial situation, and our team will handle the rest.