23 May The Ultimate Guide to Finding the Right Home Loan in Melbourne

Summary: Discover how to find the right home loan in Melbourne with this ultimate guide by MBG Services. Learn to compare lenders, understand loan types, and get tips to boost your approval chances. Make confident, informed decisions on your property journey!

Buying a home is an important milestone for many people. However, navigating the complex world of home loans can be daunting. What many individuals need to understand is that, though there are many options available, making a minor mistake can turn out to be a costly decision. They might also have legal problems. So, if you are planning to apply for a home loan in Melbourne, then you need to ensure that you find the right loan that not only suits your financial situation but also your long-term goals.

Understanding Your Financial Situation

Before applying for loans, it is vital to have a clear understanding of your financial situation. Hence, the things you need to do are evaluate your income and expenses, savings, and, most importantly, your financial goals. By doing so, you will get a realistic picture of how much money you can pay towards a mortgage payment each month.

Assessing Your Eligibility

Once you have a clear understanding of your financial situation, it is important to assess your eligibility to apply for a home loan in Melbourne. The important factors that lenders consider before giving loans are employment history, credit score, down payment, etc. Having a good idea about all these will help you narrow down suitable loan options for your specific situation.

Comparing Lenders and Loan Terms

If you want to save money in the long run, it is important to compare interest rates and loan terms. You should also check the lender’s reputation. Hence, you need to do good research and do not hesitate to ask questions. By doing so, you will increase your chance of getting the best deal.

Consulting with Professional Mortgage Brokers

Professional mortgage brokers can help you get a home loan in Melbourne, depending on your needs. They have the skills and experience and can provide good information about the market and recommend reputable lenders. Not only that, they might also make you understand the loan terms, how much money you can borrow, prepayment penalties, loan duration, and much more. They might also offer guidance on finding homes within your budget.

These are a few important things you need to do to be successful in getting home loans without problems.

If you are looking for a trusted mortgage broker who can help you get home loans fast without any issues, then you don’t have to waste your time anymore. MBG Services is your premier destination that specialises in helping people get loans and fulfil their dream of living in their own homes. We are well renowned for offering top-notch assistance to people who want to get car loans, refinance loans, home loans in Melbourne, investment property loans, commercial loans, asset finance loans, company loans, etc. As we have been in the industry for years and have been successful in helping our clients professionally and efficiently, you can be sure of getting exceptional results. To book an appointment with our team, you can give us a call now. For further queries, you can send an email, and we will reply to you soon.

Your Questions Answered

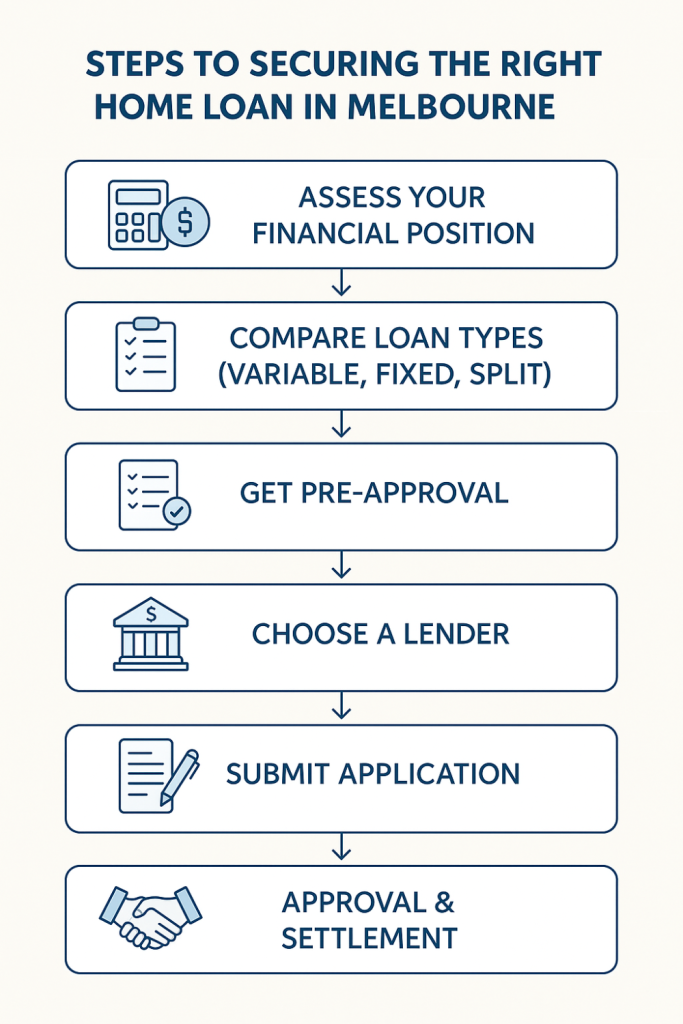

- Assess your finances, credit history and borrowing capacity before you start house-hunting.

- Help you plan how much deposit you need and connect you with lenders offering low-deposit loans or government incentives.

- Guide you right through from deposit savings, pre‑approval, making an offer, right up to final settlement .